Season 2, Episode 8;

The Future Of Finance

A Glimpse at the Next 5 Years of Banking, Investing and Insurance

A webcast presented by the global innovation practice Futureproofing : Next (futureproofingnext.com).#FutureproofingNow #FutureofFinance

OVERVIEW:

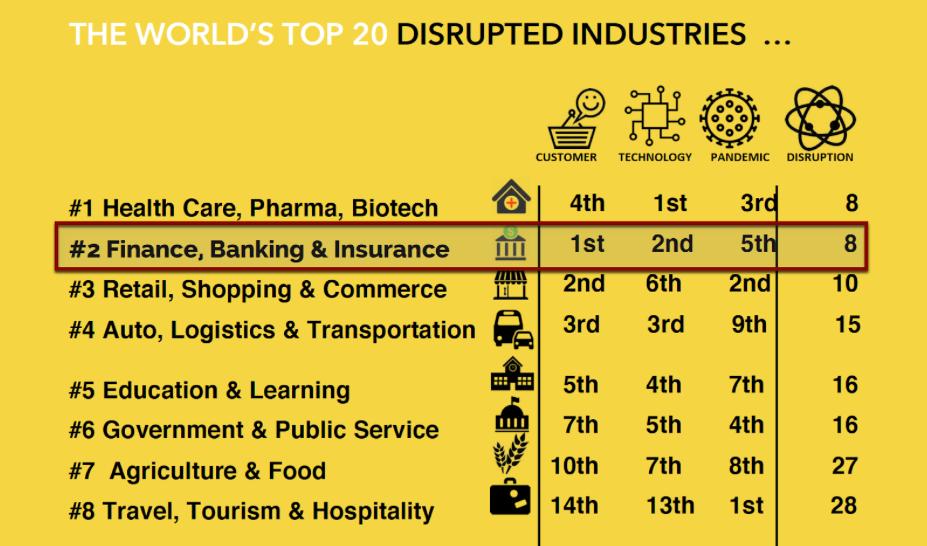

For the greater part of the last century, finance operated above the fracas of most year-to-year marketplace shifts. Now it’s part of a perfect storm of change. The finance world is not only a $30 trillion industry annually but it has also been deemed the most disrupted industry, with threats from all sides.

Futureproofing Now hosts Sean Moffitt & Andrea Kates engage with panelists from the banking, investment, insurance and fintech worlds to imagine what the face of finance will look like over the next five years.

GENERAL BACKGROUND FOR THE DISCUSSION:

What’s changing? How will technology impact the sector? How will the customer and their demands change? How will the business model of finance change? What does all of this mean for the future of finance work? Who is climbing, winning and losing? What will be the burden of regulation and compliance? Where will future threats will most likely come from?

IN THIS EPISODE:

– The biggest dynamics shifting the world of Finance

– Expert commentary on changes in key finance sub-sectors

– What all these shifts mean for the world around us

– A landscape on who will and who won’t be at the top of the pile five years from now (and why)

– What the incumbents and revolutionaries need to do to get “traction” in this new world

– What leaders should focus on to futureproof their organizations

CO-HOSTS

Sean Moffitt + Andrea Kates, Futureproofing : Next

PANELISTS

Jessica Ross, SVP Finance, Office of Transformation, Salesforce [Global]

Thomas Krogh Jensen, CEO Copenhagen FinTech [Denmark]

Amy Dawson, Head of North America Innovation, Visa [North America]

Mario Hernandez, CEO OpenFinance2020 [Mexico]

Originally recorded::

Tuesday, April 21st, 2020

Episode Hashtags:

#FutureproofingNow #FutureofFinance

Futureproofing Now Webcast Video

Futureproofing Now Podcast Audio

Hosts & Guests

Sean Moffitt

Andrea Kates

Jessica Ross

Thiomas Krogh Jensen

Amy Dawson

Mario Hernanadez

Resources

Our website Futureproofing : Next

Salesforce: Website

Copenhagne Fintech;: Website

VISA: Website

Open Finance 2020: Website

See our book at:

https://futureproofingnext.com/thebook/

Share Episode

Futureproofing Now Hosts:

Sean Moffitt

Andrea Kates

About This Episode

CONVERSATION TOP-LINE BRIEF

Futureproofing : Next leaders Sean Moffitt and Andrea Kates set the stage with insights on early signs of transformation in the world of finance.

ANDREA KATES: WE NEED TO LOOK BEYOND TRADITIONAL LINES OF DEMARCATION IN FINANCE TO IMAGINE HOW BUSINESS CAN ADDRESS THE EMERGING CONSUMER PRIORITIES. “We don’t believe you have to predict trends with perfection, but we do believe that everyone needs to have sensors in the market to sense the long-tail early signs of shifts.”

SEAN MOFFITT: ARE WE EXPERIENCING THE TURNING OF THE PAGE IN FINANCE? “To what extent should finance yield to human values? What will it take to rebuild trust and consumer confidence in the next wave of transformation in finance? How can we interpret moves like Blackrock’s sustainable investment fund–symbolic or substantive?”

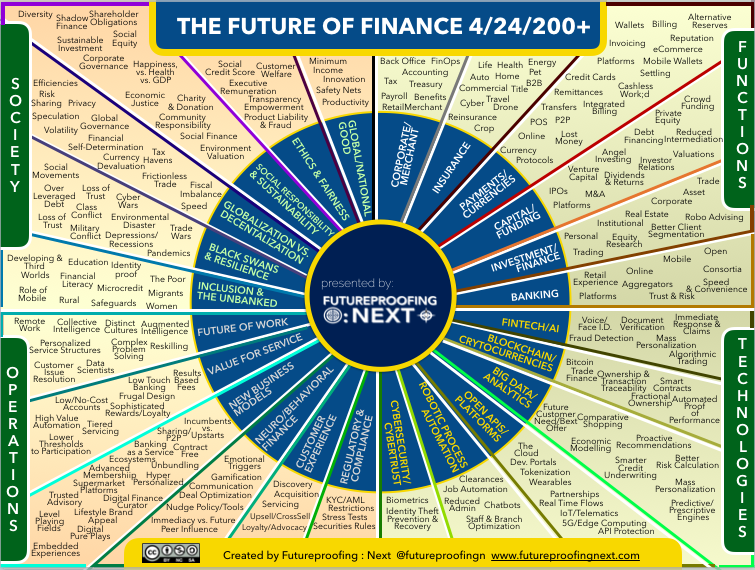

The Futureproofing : Next Future of Finance map illustrates forces on the horizon in Society, Functions, Operations, + Technologies. The graphic defines elements that will be woven into strategies in retail, manufacturing, healthcare, platform development, and all aspects of transactions, banking, payments, credit, insurance, investment and currency.

“A conversation about finance goes hand-in-hand with a conversation about technology.”

HEADLINES

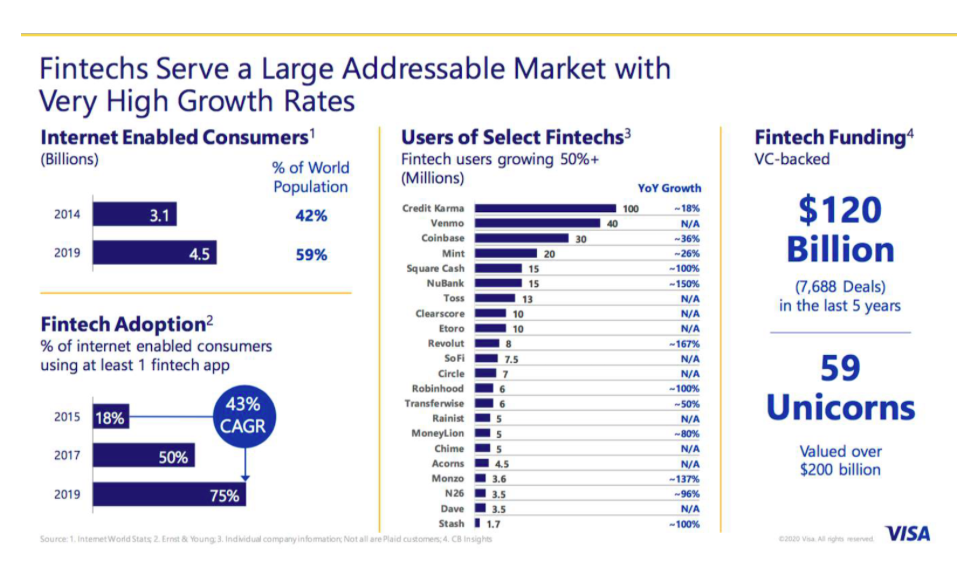

Mark Carney wondered How the Economy Must Yield to Human Values. Ray Dalio on TED Connect pieced together the puzzle parts with a combination of pessimism on the post-COVID economy and deep thinking about the ramifications that will spiral out over the coming months. And, fintechs reached 75% market penetration in 2019 (as compared with 18% in 2015).

FOLLOW THE MONEY?

What is finance? What’s changing in payments? Which technologies enable the leveling up of value exchange, inclusion of people who were previously unbanked, creativity in how to operate across borders? How can business serve emerging human needs? How can insights about shifts in finance help business leaders create a future we all believe in?

HIGHLIGHT REEL:

(11:00) JESSICA ROSS, SVP Finance, Office of Transformation. SALESFORCE

EXPERIENCE IN THE TUMULT OF CORPORATE CHANGE PREPARED JESSICA TO BE A TRANSFORMATION LEADER.

A career beginning in traditional finance with Arthur Andersen led to positions with Deloitte, Kaiser Permanente, Gymboree, Stitch Fix and now Salesforce. The common denominator has been learning to navigate through the dissolution of a firm, the reform of an industry, bankruptcy, IPO, and now the support of a company that aspires to double in size (2019 revenues were $13 billion.)

(14:00) JESSICA ROSS: Leading transformation means having one foot firmly in today’s operations and one eye looking toward the future at all times. As a Finance Organization, we need to get our arms around all of the obstacles–the hairiest and most uncomfortable things that will prevent us from getting to our goals.

(16:00) JESSICA ROSS: There are three tensions in driving a futureproofed finance function at Salesforce. 1. Accountability 2. Motivation 3. Inspiration

(18:00) JESSICA ROSS: It’s important to have a North Star we can optimize for. In our case, driving toward a $35 billion dollar business and staying in touch with customers sets the stage. To futureproof, we live by a clear vision:

“To be the world’s most admired finance organization, driving stakeholder success and enabling durable growth.”

(21:00) JESSICA ROSS: Companies I admire with strong Futureproofing capacity: Peloton because of their business model. Stitch Fix because of the combination of customer centricity and rich AI insights. Ford and GM because they have proven to be resilient in the COVID crisis providing PPE for health workers. And, McMullen—a local Oakland California boutique that exemplifies the personalized service that companies in the community need to embrace to serve their customers. The week after they shut down for quarantine, I got a personalized gift box from them and they pivoted to an all-digital platform. And of course, the Ask Gary video series from Southwest Airlines–an authentic demonstration of putting people first.

(23:00) Advice I’d give to Finance leaders trying to bring transformation to their companies: Dig out the Skeletons that are preventing your business from getting to the next level. Work with your teams to figure out: How will we tackle this?

THOMAS KROGH JENSEN, CEO, Copenhagen Fintech

(28:00) MOVE BEYOND A NARROW DEFINITION OF CAPITALISM to focus on SOCIETAL NEEDS. Post-COVID you realize how much community really matters. We understand in a very real way what it means for local businesses to struggle. Our neighbors — real people. It’s impressive how some companies like Lego and large retailers have stepped forward to say they want to pay invoices they owe to small vendors immediately instead of the normal 90 days. This is a moment when it’s clear we’re all in this together.

(30:00) COMMUNITY MATTERS. Whatever comes after the pandemic, those that do well are those who have their VALUES in order and behave accordingly. We support a national crowdfunding platform. It’s been written into some of the Danish government relief packages. Crowdfunding is a way to provide liquidity.

(32:00) WILL SUSTAINABILITY MATTER MORE OR LESS POST-PANDEMIC? There’s an argument to say more. You can’t get any airtime in the Nordics unless you’re able to frame what you’re doing within the context of the Sustainable Development Goals (SDGs). There’s a significant focus on sustainability, impact and ethics.

(35:00) The Future of Finance is related to INDUSTRY CONVERGENCE. It used to be that finance was limited to the traditional financial sector, but now Finance has become much more horizontal. There’s innovation in so many business models that integrate finance into other industries: retail, B2B, consumer.

(36:00) RADICAL OPENNESS OF DATA of course is going to be central to Finance. Open data, Open APIs, Open Banking…ultimately Open Finance. There are early signs that some Fintech companies are driving toward giving data control back to the consumer.

AMY DAWSON, Head of North America Innovation, Visa [North America]

(38:00) VISA DIGITIZED CASH A LONG TIME AGO. Visa is a network. We issue credentials through banks that can be accepted at merchants. We refer to ourselves as the original fintech company—we digitized cash a long time ago.

(39:00) THE INNOVATION ROLE IS LARGELY EVANGELISM + HELPING OUR PARTNERS TO UNDERSTAND WHAT THE FUTURE MIGHT BE. We need to address the business to business needs, but we see ahead by also having deep insight into the “C”, the customer, being served by our business partners. We dive into ethnographic research to understand customer needs enabling the movement of money and are vigilant about learning about customer priorities in areas like security.

“We need to listen for what customers know they want as well as what they don’t know or can’t articulate.”

(40:00) We also do co-creation to drive net new product development. We identify themes, incubate early stage initiatives, develop proof of concept projects and pilots. Ultimately, if they pass the tests, they’ll graduate and become commercialized products.

(41:00) TRENDS AHEAD. The last decade was around DIGITAL TRANSFORMATION, CONSUMER EMPOWERMENT—make it speedy for me, make it flexible—and MOBILITY. Tomorrow we’ll see DIGITAL SYNERGY enabled by AI. INDIVIDUAL EMPOWERMENT (where individuals understand the value of their data and their contribution). UNBOUND: where rather than being tethered to a device (like mobile), innovations related to data in the cloud and more flexible credentialing allow us to interact and transact in entirely different ways.

(44:50) NEW DYNAMICS. WHAT VISA IS DOING IN THE MIDST OF THE PANDEMIC. COMPANIES THAT BUILD ON 5 KEY THEMES WILL BUILD CONSUMER LOYALTY POST-COVID BY TAPPING INTO THE UNDERLYING NEEDS PARTICULAR TO THIS MOMENT. First, we looked at the US markets that were most affected: New York, California and Massachusetts. We learned that there were 5 themes at play.

THEME ONE POST-COVID: SNOOP DOGG LYRIC SUMS IT UP: With my mind on my money and my money on my mind. Concerns about cash–germs, viruses. So that sets the stage to accelerate adoption of contactless payments.

THEME TWO POST-COVID: Worries about financial security.

THEME THREE POST-COVID: THERE REALLY ARE NO GOOD SOLUTIONS RIGHT NOW. ONLY TRADEOFFS. Example: a consumer worried about being exposed to the virus by being at a grocery store has the option of delivery. But that comes with a higher price and not everyone is in a position to afford that option.

THEME FOUR POST-COVID: “We’re all in this together.” Communities matter and awareness of the importance of local businesses needing to thrive, even as the large companies like Amazon are providing convenient commerce. Neighbors reach out through platforms like Next Door.

THEME FIVE POST-COVID: HUMAN SPIRIT: MAKING LEMONADE. How can I take the time I potentially have to focus on family or get creative.

ADVICE FOR BUSINESSES TRYING TO FUTUREPROOF: Consumers are hyper aware of values and ethics. Start there before you solve the technical aspects of developing products.

MARIO HERNANDEZ

(51:00) In my career, I shifted from living in Spain and operating as part of large companies (Santander, BBVA–where in 2007 they introduced the digital wallet) to my current role as an entrepreneur in the payments, ewallet, and platform provider as well as convener of OpenFinance2020 a hub located in Mexico City and serving LATAM. What many people don’t realize is, that’s a 600 million person market. And, as a hub, we also engage in global partnerships and collaborations.

(53:00) FINANCIAL INCLUSION MUST BE PART OF THE SOLUTION. The underserved represents about 50% of the market in LATAM. That means we need to integrate the needs of those underserved and potentially unbanked into a post-COVID world.

(54:00) Biggest untapped need: ALTERNATIVE LENDING is something we must solve. We run a SME public-private partnership. I believe we can apply machine learning and AI to craft new ways to integrate data into the development of new products.

(55:00) COVID HAS FLATTENED THE WORLD. WE’RE MORE PANGEA THAN SEPARATE CONTINENTS. We believe we need to get insights in regulation from Colombia, Central Bank of Mexico started an Open Banking approach (Europe had it some years ago), the power of data to personalize financial services has reached a new level.

(57:00) WILL THE FUTURE OF FINANCE BE DRIVEN BY TECHNOLOGY FIRST OR CONSUMER SENTIMENT FIRST? Technology is an enabler, but people will be at the center more than ever. Fraud detection, risk management has to be tackled in any platform and we’ve seen several attacks as well.

Our F:N Expert Panelists:

Jessica Ross

Senior Vice President /Global head of the Finance Office of Transformation at Salesforce

Jessica Ross is Senior Vice President and global head of the Finance Office of Transformation at Salesforce. In this role, she is responsible for developing the Finance organization’s vision and roadmap for scale and growth in the face of the fourth industrial revolution and beyond.

Immediately prior to joining Salesforce, Jessica served as Vice President Controller at Stitch Fix, where she was instrumental in the company’s November 2017 IPO, as well as in the team’s ongoing transformation from a private to a publicly traded company.

Jessica’s professional experience includes more than 20 years in progressive leadership roles in finance, including 12 years of public accounting experience between Arthur Andersen and Deloitte. Her career, which has also included roles at Kaiser Permanente and Gymboree, has been characterized by a deep commitment to leadership, people development, transformation, and growth.

Thomas Krogh Jensen

CEO, Copenhagen Fintech

Thomas Krogh Jensen has extensive experience with leadership and management in large Nordic and global financial institutions on a senior level. He has always practised leadership (from mid to senior management) in a change management and transformational context. Whether operational or strategic, the keywords have been management of significant changes along with the ability to execute and transform strategies into everyday actions.

Anchored in the Nordic region’s renowned design and digital traditions, Thomas’ organziation, Copenhagen FinTech, strives to support human-centric financial solutions with the potential to shape our global society. At Copenhagen FinTech, he is building the most inclusive and expansive FinTech ecosystem. With a focus on human-centric solutions for a greater purpose, he help sstartups get off the ground by connecting them with financial institutions, research organizations, governments, NGOs and individuals who want to make a difference.

Thomas creates uncommon connections between these innovation-seeking groups, and we foster collaboration at every step of the development process – from start-up to scale-up and everything in between with a variety of services.. He wants to position Copenhagen, Denmark and the Nordics as one of the leading FinTech Hubs in the global financial services industry by supporting and catalyzing the next era of technology-led corporate and start-up innovators.

Amy Dawson

Head of North American Innovation, VISA

Amy Dawson is Visa’s Head of North America Innovation. Visa’s Innovation Centers work collaboratively with partners to explore, pilot and commercialize cutting edge commerce solutions and experiences. She has over 20 years of experience in business strategy, product management, marketing, analytics and innovation.

Prior to Visa she was SVP, Enterprise Innovation, Digital Strategy & Operations for U.S. Bank where she was responsible for building an innovative culture and a pipeline of digital innovations. Previously, she has worked at Charles Schwab, Solidus Networks (biometric start-up), Diamond Management & Technology Partners (acquired by PWC) and Ford Motor Company. Amy is part of Pipeline Angels, an organization that provides angel investment to women entrepreneurs.

She has a MBA from the University of Michigan, Ross School of Business, and a BSBA in Finance and Marketing from The Ohio State University Fisher College of Business. She has also completed executive education series in innovation and design thinking at U.C. Berkeley Haas School of Business, California College of the Arts and Stanford University. She resides in San Francisco and is the pack leader of 2 dogs, 2 children and 1 husband.

Mario Hernandez

CEIO, Open Finance Sunmit/EOS

Tech executive with over 20 years of experience from engineer attending Exec Programs Babson College, ESADE and HBS. Currently CEO at EOS Fintech Group – SMB & payments platform in Mexico and OPENFINANCE SUMMIT – the most international and exclusive event in LATAM.

Prior to EOS, Mario was the CEO and Owner of a FS technology company focused on Digital Banking, and processing electronic payments – named most innovative tech startup company by the European Commission with over 700 employees and 50M USD in revenues with operations in USA, Europe and Latam. He is a keynote speaker for the future of banking and fintech: ISACA, Mobile World Congress, Forbes, G&D, BBVA Open Innovation, Mentor of MIT, Alibaba, and Santander Startup programs.

Specialties: Entrepreneurial management, corporate development, product development, business operations, strategy, product marketing, non-profit governance.

The Six Hero Visuals:

COME to Know Us. Say Hello. 你好. Hola. مرحبا. Guten Tag. Bonjour.

We’re hungry to do work with passionate, driven people. The future is unwritten, let’s bring some future chapters to life.

San Francisco – Toronto – Global

+416 458-2818

hello@futureproofingnext.com